TransferWise Review – Exchange Rates & Fees

How can you use TransferWise to send money abroad? Is their service reliable? Can you trust TransferWise with your money? How good are their fees and exchange rates?

Platformceo score

Our independent review of TransferWise

TransferWise review

TransferWise is a Great money transfer service (8.8/10) recommended by Monito. TransferWise is highly reputable and trusted by more than 7 million customers (10/10), has a very high number, and percentage of customer reviews on TrustPilot (9/10), offers competitive rates (8.8/10), and is very easy to use (8/10).

TransferWise mobile apps review

TransferWise mobile apps have great ratings on Apple’s App Store (4.7/5 stars on 19,300 ratings) and Google’s Play Store (4.4/5 on almost 80,000 ratings). According to TransferWise customers, the app is “an invaluable tool for anyone moving money internationally”.

TransferWise fees and exchange rate

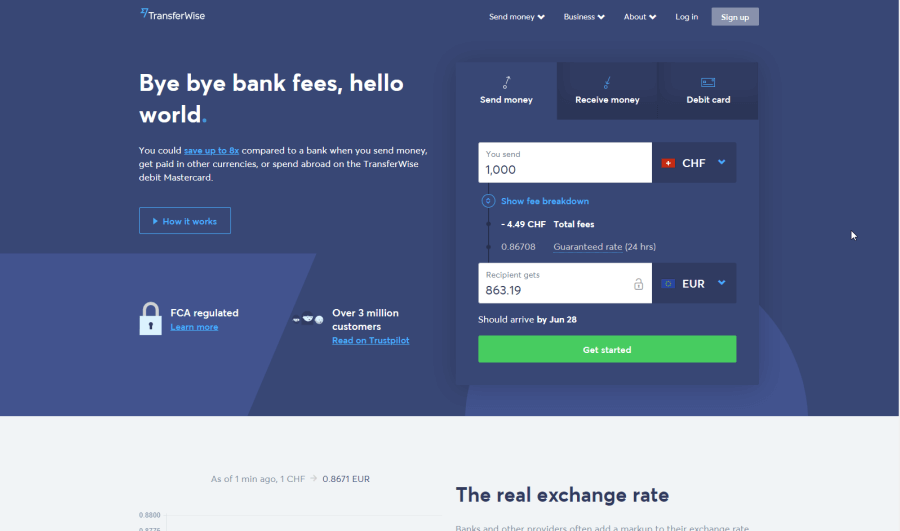

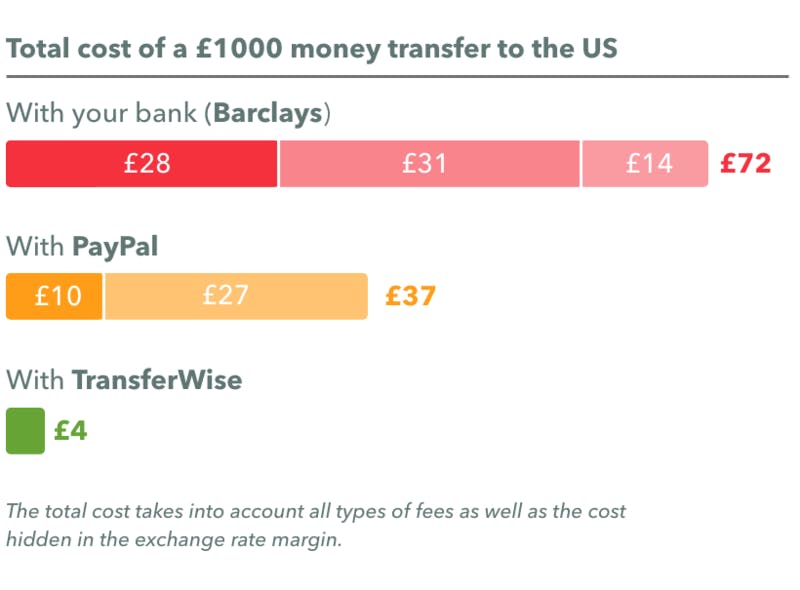

TransferWise is an innovative international money transfer provider that is often dubbed the “Robin Hood” of the money transfer industry. They focus on making bank transfers more affordable than traditional banks by charging low and transparent transfer fees and converting money at the true mid-market exchange rate. In other words, there’s zero markup on the exchange rate. (As a comparison, banks usually give customers an above-market rate, the margin is part of their fees and in general, they are not transparent about this.)

TransferWise services and coverage

TransferWise currently supports sending money to 71 countries and sending money from 43 countries. The company covers 1000+ routes (country combinations) across 57 currencies, and they are also one of the few companies offering the true mid-market rate.

Most currencies supported by TransferWise offer one option: a bank transfer from one bank to another. For some currencies, you can pay with debit and credit cards or use a SOFORT transfer option. Apple Pay or Android Pay is also available for certain currencies via TransferWise iOS and Android apps. In most cases, the recipient will get the money within one to two business days.

TransferWise is a top choice for international money transfers. They are known for their great customer service, have excellent reviews on Trustpilot, and provide speedy transfers. And the cherry on the cake? They also provide spectacular user experience, from an easy sign-up process to efficient transfers, Some users were so impressed they thought it is too good to be true. Yes, it’s good, but it’s also true! They’ve seen massive growth since 2011 and are an extremely competitive, high-profile disruptor of the traditional money transfer model. TransferWise is frequently referred to as a no-nonsense company that is sparking a revolution.

TransferWise is rated 5 stars out of 5 by over 62207 customers on Trustpilot

What we like about TransferWise

-

You get the true mid-market rate

-

Low and transparent transfer fees

-

Fantastic user experience

-

Exceptional customer reviews on Trustpilot

What we dislike about TransferWise

-

You can only send to a bank account

Compare TransferWise's transfer fees and Exchange rates

Sending money abroad could cost you a lot, especially if you aren’t aware of the hidden fees in the currency exchange rate margin.

Borderless Accounts & Cards

A borderless account is a multi-currency account that enables you to hold money in over 40 currencies and convert them at the mid-market exchange rate whenever you want–for example when the rate is favorable to you. It’s equivalent to having local bank accounts across the world in one compact digital space, essentially a “virtual” bank account in various different countries, that acts exactly like a local bank account. You get a sort code/routing number, account number, SWIFT / BIC, and IBAN codes that you can use to easily make and accept payments in a local currency. You can transfer money between currencies at TransferWise’s mid-market rates and low fees. The first virtual bank account you get will be in your default currency. You can add other currencies and localities as needed. For any country where you want a local presence, TransferWise provides you with a unique sort code / routing number and account number for that bank account.

You also get a free TransferWise debit Mastercard plus personal account numbers and bank details (currently these details are for USD, GBP, EUR, NZD and AUD, though they plan to add more currencies in the future. The borderless account also enables you to receive money with no fees from over 30 countries.

TransferWise is very well-known for being easy to use, and this account is no exception. At present, the account can be used through TransferWise’s website or app, and by using the virtual bank account details to make and receive payments. Your clients and vendors can demand, make, and send payments the same as with any other local bank account.

Fees

You don’t pay any fees for accepting money or making payment in a local currency. You only pay fees when you convert money between different currencies. You do pay a fee for adding money to the account with some debit and credit cards. There is a small fixed fee for moving money between your Borderless Account and a regular bank account, typically around £0.50 / $1.30 / 0.60€.

How does this benefit me?

Imagine you are a US-based business, but you take payments and pay suppliers in the US, UK, and Europe. You can setup your TBA in the US, then “add on” virtual bank accounts for the UK and Eurozone. You get local bank details for those areas and can effortlessly make and receive payments in Pounds Sterling and Euros.

Who is the account designed for?

The TBA is an extremely helpful solution for businesses and freelancers who have international customers, clients or operations in general. They won’t have to pay expensive international wire fees or suffer from the poor exchange rates traditionally offered by banks.

The fees and exchange rate and fees are the same as for private customers, however there are some restrictions on certain currencies for business customers. The list of TransferWise currencies with restrictions for sending from or to a business account are the following: GBP, EUR, CHF, PLN, DKK, NOK, SEK, BGN, CZK, GEL, HUF, RON, IDR, KRW, LKR, MYR, PHP, CNY, SGD, THB, AED, COP, MAD, MXN, ZAR, VND.

Payoneer Card blocked, balance frozen ??

With TransferWise You Can Solve Your Problem

The cheap, fast way to send money abroad…

7,000.000+ Users Worldwide, TransferWise Works!

We have no business ties to Wirecard.

Our cards is issued by TransferWise

We Have own issuance license for cards through Mastercard

Join over 7 million people who get the real exchange rate with TransferWise. We’re on average 8x cheaper than leading UK high street banks.

Get a free international Transfer of up to $500

Create an account with TransferWise

You can signup for TransferWise using an email address, or an account with Facebook or Google. It takes a couple clicks and then you're done.